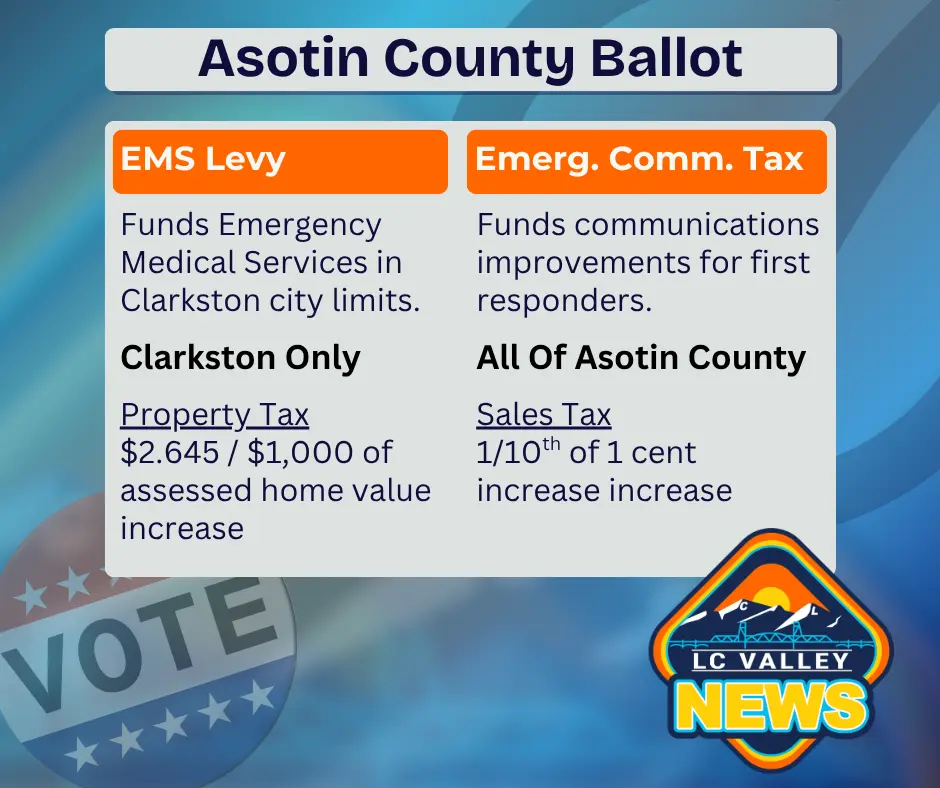

There are some questions popping up in Asotin County about the difference between the Emergency Medical Services Tax Levy and the Emergency Communications Tax for all of Asotin County.

The EMS Tax Levy is only for residents of the City of Clarkston. If you live outside the city limits, you won’t see it on your ballot. The EMS Tax Levy was put forward by City Councilors in Clarkston to pay for emergency medical services inside the city limits. It would increase property taxes by nearly $2.65 per $1,000 of assessed home value. In 2023 one estimate of the median home value was $216,900 in Clarkston (Data USA). The owner of a home of that value would pay an additional $573.70 per year.

“It’s unfortunate that both of these ballot measures have the word “emergency” in them because it creates confusion and it’s understandable.”

Asotin County Emergency Management Director Nick Bacon says the other emergency issue on the ballot is for everyone, not just residents of Clarkston.

“A county-wide measure on all qualified sales in Asotin County that will fund emergency communications. Which is the radio and phone systems that our dispatch and first-responders use to be able to speak to each other.”

This communications tax would not impact property taxes, only the sales tax. If approved, it would increase it 1/10th of one percent and would, among other things, allow firefighters and deputies to communicate in parts of the county where they can’t reliably get a message out right now. The current sales tax in Clarkston is 8.4%. This would increase it to 8.5%. Areas of Asotin County outside of Clarkston would rise to 8.3% sales tax.