SPOKANE, WA – Clearwater Paper Corporation, a supplier of consumer tissue and bleached paperboard, today reported financial results for the fourth quarter and year ended December 31, 2022. In a teleconference, President and Chief Executive Officer Arsen Kitch discussed fourth-quarter highlights. Among them were setbacks during a planned maintenance outage at the Lewiston mill which resulted in a loss of around $5 million, officials say.

For the final quarter of last year, the Spokane-based company reported net sales of $527 million, an 8% increase compared to net sales of $490 million reported in the fourth quarter of 2021. Net loss for that quarter was $6 million compared to a net income in the fourth quarter of 2021 of $10 million.

For all of 2022, Clearwater Paper reported net sales of $2.1 billion, a 17% increase compared to net sales of $1.8 billion for the previous year. Net income for the full year was $46 million, compared to a net loss for 2021 of $28 million.

Kitch says since early 2021, the industry has experienced high operating rates with strong demand.

He adds that the company experienced a moderation in demand late in the fourth quarter which they believe was due to customers managing inventories after a strong year, and a return to more seasonal patterns.

From a consumer demand perspective, Kitch says they believe the paperboard is economically resilient given the end-use of the products.

With fourth-quarter operating results, Kitch says they completed a planned major maintenance outage at the Lewiston mill.

Fitch says he appreciates their employees addressing these unexpected challenges under difficult conditions during the holidays.

For the tissue business, Fitch says the overall performance was strong and they continue to observe consumers shifting their demand to private-branded tissue products to help offset the impacts of inflation.

He adds that the Lewiston paperboard maintenance outage issues also negatively impacted tissue-adjusted EBITDA by approximately $2 million in the fourth quarter.

Cost inflation has outpaced price increases in the company’s tissue business over the past two years which has led to margin compression.

More details:

2022 FOURTH QUARTER HIGHLIGHTS

- Operational and weather-related issues impacted paperboard operations

- Completed planned major maintenance at the Lewiston, Idaho facility

- Net loss of $6 million, or $0.34 per diluted share, and Adjusted EBITDA of $28 million

- Net sales of $527 million, up 8% compared to the fourth quarter of 2021

2022 FULL-YEAR HIGHLIGHTS

- Delivered strong performance due to robust demand for paperboard products

- Net income of $46 million

- Adjusted EBITDA of $227 million

- Net sales of $2.1 billion, up 17% compared to 2021 due to higher pricing and stronger tissue volumes

- Net debt reduction of $108 million in the year, $377 million since 2020

“We had a very good year, with strong results in paperboard and improvements in tissue. We continued to reduce net debt and improved our overall financial flexibility,” said Arsen Kitch, president and chief executive officer. “During the fourth quarter, we were impacted by operational and weather-related issues, which have subsequently been resolved.”

OVERALL RESULTS

For the fourth quarter of 2022, Clearwater Paper reported net sales of $527 million, an 8% increase compared to net sales of $490 million reported in the fourth quarter of 2021. Net loss for the fourth quarter of 2022 was $6 million, or $0.34 per diluted share, compared to the net income in the fourth quarter of 2021 of $10 million, or $0.56 per diluted share. On a non-GAAP basis, Clearwater Paper reported an adjusted net loss in the fourth quarter of 2022 of $5 million, or $0.30 per diluted share, compared to the fourth quarter of 2021 adjusted net income of $14 million, or $0.82 per diluted share. Adjusted EBITDA for the quarter was $28 million compared to the fourth quarter of 2021 Adjusted EBITDA of $56 million.

For the full year 2022, Clearwater Paper reported net sales of $2.1 billion, a 17% increase compared to net sales of $1.8 billion for 2021. Net income for the full year was $46 million or $2.68 per diluted share, compared to a net loss for 2021 of $28 million or $1.67 per diluted share. On a non-GAAP basis, Clearwater Paper reported adjusted net income for 2022 of $62 million, or $3.63 per diluted share, compared to 2021 adjusted net income of $17 million, or $1.03 per diluted share. Adjusted EBITDA for 2022 was $227 million, compared to 2021 Adjusted EBITDA of $175 million.

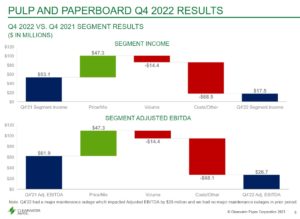

Pulp and Paperboard Segment

Net sales in the Pulp and Paperboard segment were $274 million for the fourth quarter of 2022, up 5% compared to the fourth quarter of 2021 net sales of $261 million. Segment operating income for the fourth quarter of 2022 was $18 million compared to $53 million for the fourth quarter of 2021. Adjusted EBITDA for the segment was $27 million in the fourth quarter of 2022, compared to $62 million in the fourth quarter of 2021. The decrease in operating income and Adjusted EBITDA was driven by planned major maintenance at our Lewiston, Idaho facility, operational issues at both mills and a weather event at our Cypress Bend, Arkansas facility, and higher input costs specifically related to chemicals and energy, partially offset by higher sales prices.

Net sales in the Pulp and Paperboard segment were $1.1 billion for 2022, an increase of 20% compared to 2021 net sales of $946 million. Segment operating income for 2022 was $183 million compared to $126 million for 2021. Adjusted EBITDA for the segment was $220 million for 2022, compared to $161 million for 2021. The increase in operating income and Adjusted EBITDA was driven by higher sales prices, partly offset by higher input costs specifically related to fiber, chemicals, freight, and energy and higher outage costs as well as operational issues.

Pulp and Paperboard Sales Volumes and Prices:

- Paperboard sales volumes were 188,999 tons in the fourth quarter of 2022, a decrease of 11% compared to 211,503 tons in the fourth quarter of 2021. Paperboard sales volumes were 814,556 tons for the year ended 2022 compared to 822,206 tons for the year ended 2021.

- Paperboard average net selling price increased 23% to $1,429 per ton for the fourth quarter of 2022, compared to $1,164 per ton in the fourth quarter of 2021. Paperboard average net selling price increased 25% to $1,356 per ton for the year ended 2022, compared to $1,088 per ton for the year ended 2021.

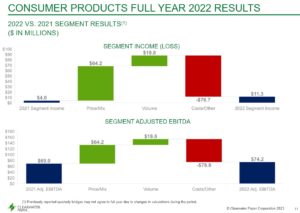

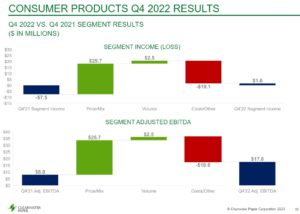

Consumer Products Segment

Net sales in the Consumer Products segment were $254 million for the fourth quarter of 2022, up 10% compared to the fourth quarter of 2021 net sales of $232 million. In the fourth quarter of 2022, retail converted case shipments were 13.0 million cases, an increase of 5% compared to the 12.4 million cases shipped in the fourth quarter of 2021. Segment operating income for the fourth quarter of 2022 was $2 million compared to an operating loss of $8 million in the fourth quarter of 2021. Adjusted EBITDA for the segment was $18 million in the fourth quarter of 2022, up from $8 million in the fourth quarter of 2021. The increase in operating income and Adjusted EBITDA was driven by higher sales prices and volumes partially offset by higher input costs, primarily pulp and energy, along with general inflation for other input costs.

Net sales in the Consumer Products segment were $950 million for the full year 2022, up 14% compared to 2021 net sales of $835 million. For 2022, retail converted case shipments were 50 million cases, an increase of 10% compared to 46 million cases shipped for 2021. Segment operating income for 2022 was $11 million, compared to an operating income of $4 million for 2021. Adjusted EBITDA for the segment was $74 million for 2022, an increase from $69 million for 2021. The increase in operating income and Adjusted EBITDA was driven by higher sales prices and increased volume partially offset by higher input costs, primarily related to pulp, energy, and freight.

Retail Tissue Sales Volumes and Prices:

- Retail tissue volumes sold were 80,766 tons in the fourth quarter of 2022, an increase of 2% compared to 79,491 tons in the fourth quarter of 2021. Retail tissue volumes sold were 309,735 tons for the year ended of 2022, an increase of 8% compared to 287,987 tons for 2021.

- Retail tissue average net selling prices increased 9% to $3,095 per ton in the fourth quarter of 2022, compared to $2,831 per ton in the fourth quarter of 2021. Retail tissue average net selling prices increased 9% to $3,010 per ton for 2022, compared to $2,771 per ton for 2021.

COMPANY OUTLOOK

“Our focus in 2023 is on improving our operational performance while continuing to generate strong free cash flows,” Kitch says. “Our businesses have proven to be economically resilient, and we are well positioned to deliver strong results this year.”

ABOUT CLEARWATER PAPER

Clearwater Paper is a premier supplier of private brand tissue to major retailers, including grocery, club, mass merchants, and discount stores. In addition, the company produces bleached paperboard used by quality-conscious printers and packaging converters and offers services that include custom sheeting, slitting, and cutting. Clearwater Paper’s employees build shareholder value by developing strong relationships through quality and service.

Clearwater-Paper-Reports-Fourth-Quarter-and-Year-End-2022-Results-2023